Quick tax refund calculator

The total tax paid for the year will include any advance taxes TDS TCS tax collected at source and self-assessment tax. This calculator is FREE to use and will give you an instant Australian tax refund estimation.

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

The best starting point is to use the Canadian tax refund calculator below.

. Your tax situation is complex. The IRS says you should file early. Welcome to our Australian Tax Refund calculator.

Deduct the amount of tax paid from the tax calculation to provide an illustration of your 202223 tax refund. Use tool Earned Income Tax Credit Estimator. Fastest federal tax refund with e-file and direct deposit.

If youve ever worked Down Under you probably paid tax and are due an Australian tax refund. Raja I have used capital gain calculator by simple tax India on my 14 years old house in my home town sold for Rs3000000- purchase for Rs 1716092- in 2005. When you are filing your IT returns you can do your income tax refund calculation after taking all deductions and exemptions into consideration.

So it definitely pays to make sure youre doing everything you can to maximise your refund. Govt valuation is Rs 1993200-. You need to lodge your tax.

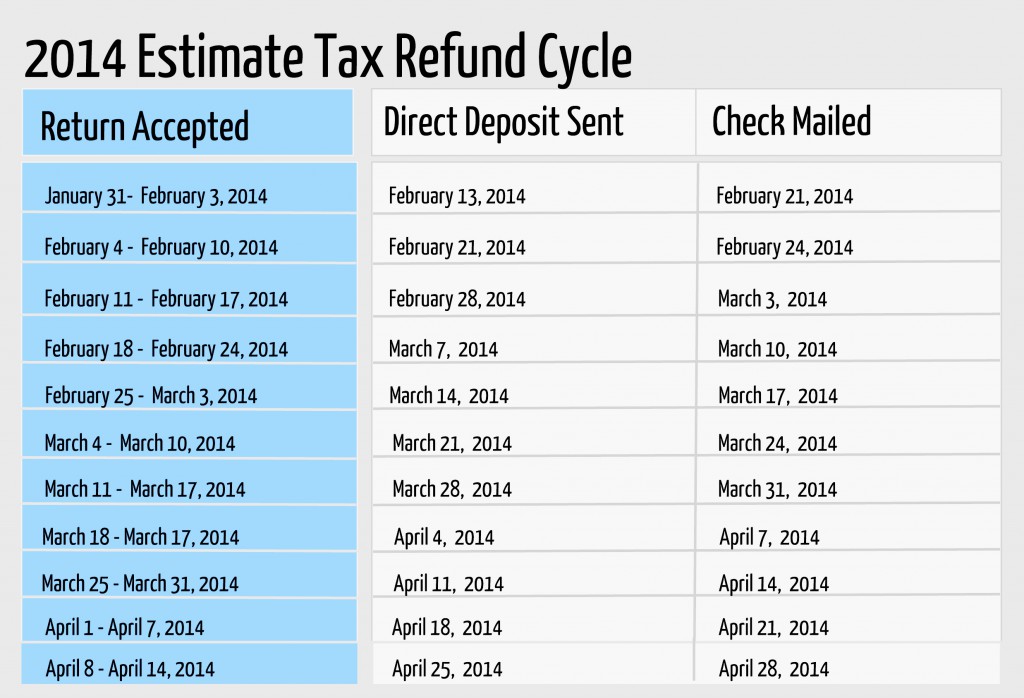

Calculate your total tax due using the CA tax calculator update to include the 202223 tax brackets. As the year ends many folks start to look at their taxes and assess how much money they might be getting back in their tax refund. Tax refund time frames will vary.

Pass-Through Entity Fiduciary Income Tax Interest Calculator Tax Research Tax Alert Archives. The new tax regime offers lower tax rates as compared to the old tax regime. The IRS issues more than 9 out of 10 refunds in less than 21 days.

It takes just 2 minutes to use and could lead to you getting a significant amount of UK tax back. Looking for a quick snapshot tax illustration and example of how to calculate your. Please be mindful that our tax calculations are only estimates.

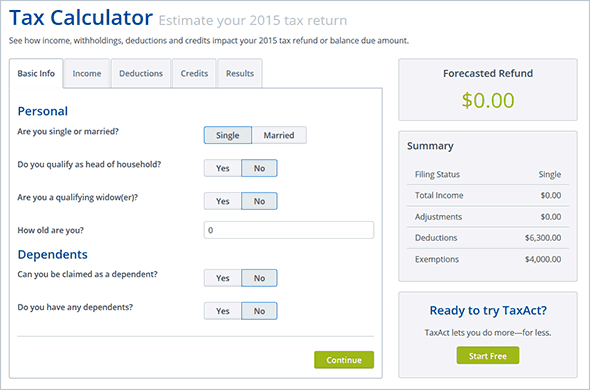

Use the free UK tax refund calculator. 2022 free Canada income tax calculator to quickly estimate your provincial taxes. See how income withholdings deductions and credits impact your tax refund or balance due.

The HR Block tax calculator 2022 is available online for free to estimate your tax refund. See Publication 505 Tax Withholding and Estimated Tax. Estimate your tax withholding with the new Form W-4P.

Refunds from Delaware tax returns generally take four to 12 weeks to process. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022. To find out what your final tax return summary will look like call 13 23 25 and let our tax accountants walk you through the tax refund process with ease.

A lot of people arent sure if they are due UK tax back so this is a very useful tool. This handy tool allows you to instantly find out how much Canadian tax back you are owed. You have nonresident alien status.

How to calculate your tax refund. It is not your tax refund. California Tax Calculator - Quick Tax Estimator.

Use tool Estate Tax Liability. This includes alternative minimum tax long-term capital gains or qualified dividends. Share this Helpful Links.

Short-term capital gain or loss This is the total profit you realized from the sale of assets such as stocks bonds collectibles and other asserts owned less than one year. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. 202223 California State Tax Refund Calculator.

Income Tax Refund Total Tax Paid for the Year Total Tax Payable for the Year. 202223 Tax Refund Calculator. Choose a different State.

Given that this tool comes in handy we wanted to break down the HR Block Tax Calculators process and provide a little education on how the HR Block Tax. Tax filing season always begins in September after the tax year finishes 2023 Mar 2022 - Feb 2023 2022 Mar 2021 - Feb 2022 2021 Mar 2020 - Feb 2021 2020 Mar 2019 - Feb 2020 Did you work for an employer or receive an annuity from a fund. Loans are offered in amounts of 250 500 750 1250 or 3500.

Check My Refund Status May 06 2020 Agency. Over 14 million people lodge a tax return each year in Australia and of those who receive a refund about two-thirds on average they receive just over 2800 each resulting in a collective refund of more than 30 billion. Fastest Refund Possible.

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. You will need to enter your SSN and your refund amount. Please enter your income deductions gains dividends and taxes paid to.

This year you have until April 18 to file your taxes but if youre eager to receive your refund we dont recommend waiting until the last minute to file. Wheres My Tax Refund Washington DC. If you earn more than 2700000 per year your Income Tax deducted is calculated in two 2 parts.

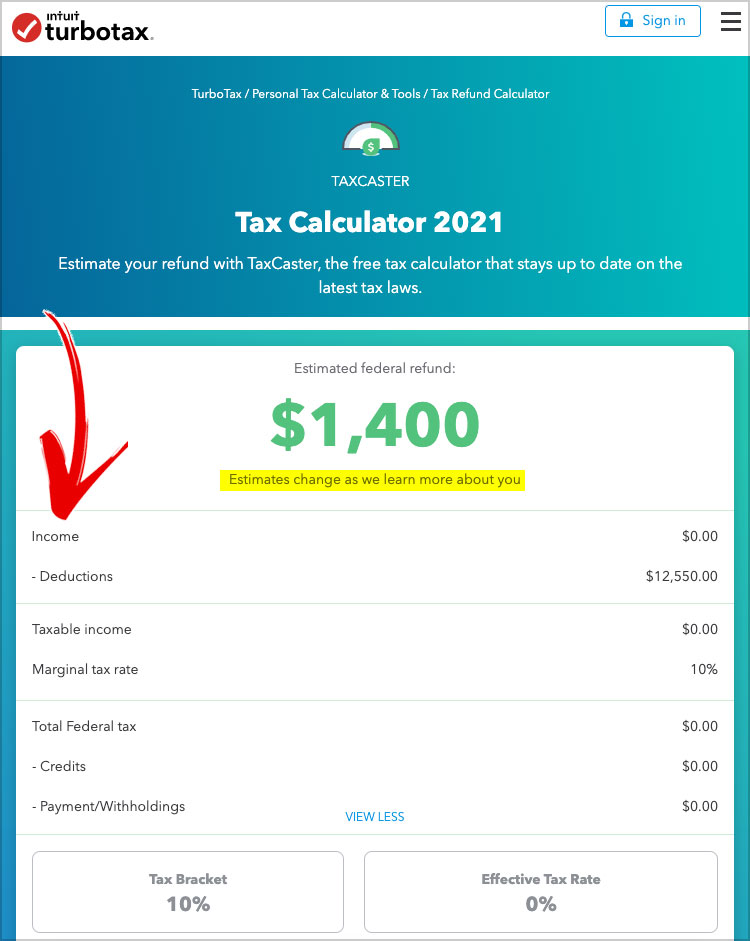

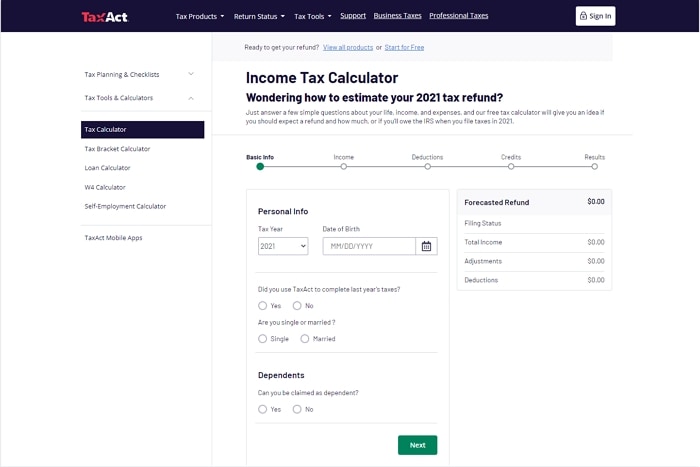

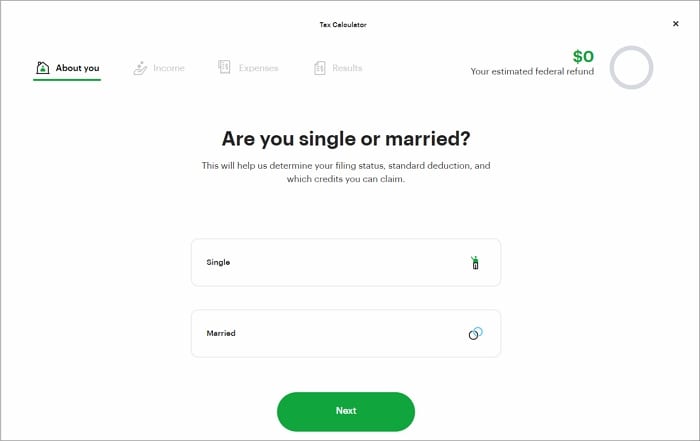

Before the deductions are made. You simply put in your details get your refund estimation and then decide if you want to apply. Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe.

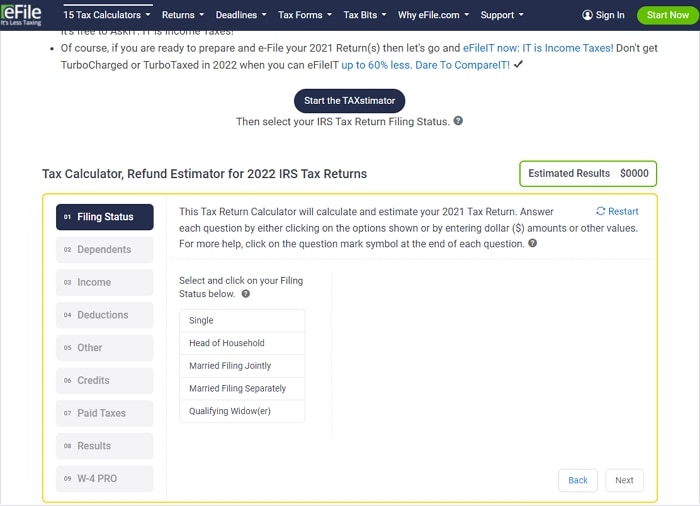

For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income deductions and credits. Whats more its no obligation to use so you can find out what youre owed and then decide if you want to proceed. The calculator will use the amount entered to calculate your spouses Schedule SE self-employment tax.

Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. Our office locator will help you locate your nearest office and you can book an appointment online. Under both the income tax regimes tax rebate of up to Rs 12500 is available to an individual taxpayer under section 87A of the Income-tax Act 1961.

Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Gross Income F1040 L7-21. This is an optional tax refund-related loan from MetaBank NA.

Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. The Canadian tax calculator is free to use and there is absolutely no obligation. Deduct the amount of tax paid from the tax calculation to.

For more specific status updates visit the states Refund Inquiry Individual Income Tax Return page. Wheres My State Tax Refund Delaware. Use tool Self.

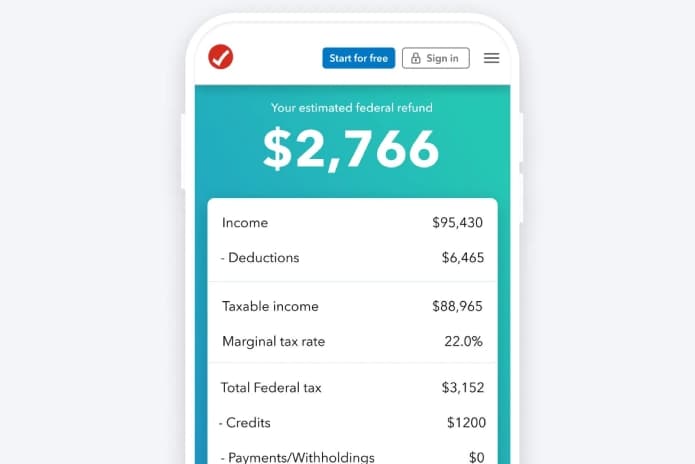

Estimate your tax refund using TaxActs free tax calculator. 13 of the gross amount needs to be calculated as your Non-Taxable Income then the following deductions are made. 1040 Federal Income Tax Estimator.

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

How To Estimate Your Tax Refund Or Balance Due Taxact Blog

See Your Refund Before Filing With A Tax Refund Estimator

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Tax Refund Estimator Factory Sale 55 Off Www Wtashows Com

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

Tax Refund Estimator Factory Sale 55 Off Www Wtashows Com

Tax Day 2019 H R Block S Tax Calculator Estimates 2018 Tax Refund

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Online Tax Calculator Deals 57 Off Www Wtashows Com

Tax Refund Estimator Factory Sale 55 Off Www Wtashows Com

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Refund Estimator Factory Sale 55 Off Www Wtashows Com

1 Free Tax Refund Estimator In 2022 Turbotax Taxcaster

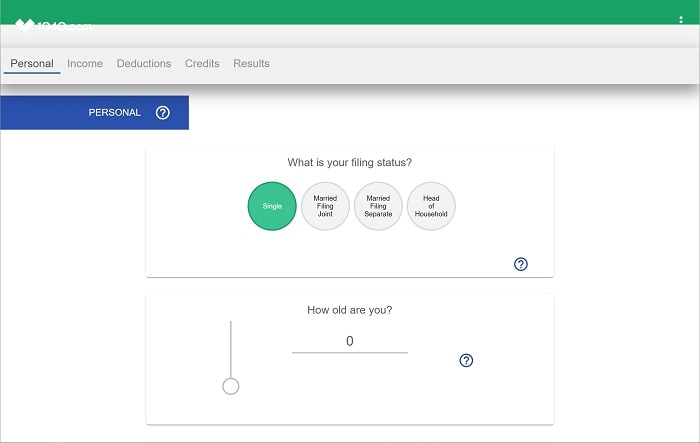

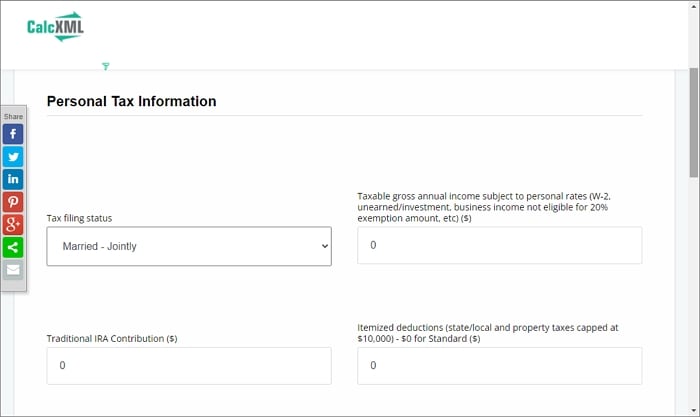

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process